Applying For An EIN For Your Business

Obtain a Business Tax ID (EIN) Number | Business EIN Number Application

Starting a new business can be incredibly exciting, but the process also requires a lot of hard, time-consuming work. To avoid unexpected administrative bumps in the road, you should obtain a tax ID (EIN) number for your business as soon as possible. Then, you have the information you need to fill out a variety of […]

Obtain a Tax ID (EIN) Number for Your Automotive Shop Business | EIN Number Application

Does an automotive shop need an EIN? A federal EIN Number is actually required for nearly every business, but it can be confusing because it isn’t given out with a business. If you’re running an automotive shop, you need to get an IRS FEIN number as early as possible. Apply for a Tax ID (EIN) […]

Obtain a Tax ID (EIN) Number for your Small Business | EIN Number Application

Even small businesses need Employer Identification Numbers, and that’s true even if the business doesn’t have employees. EIN Numbers and Federal Tax ID Numbers are one in the same: They’re a unique number used to identify your business for the federal government and financial institutions. Here’s what you need to know about getting one. Apply […]

Obtain a Tax ID (EIN) Number for your Pizza Shop Business | EIN Number Application

Most pizza shops need a tax ID number. This number identifies your business to the Internal Revenue Service (IRS) as well as to financial institutions. As an individual, you use your Social Security Number (SSN) as your tax ID number, but when you run a business, you need a special tax ID called an Employer […]

Obtain a C-Corporation Tax ID (EIN) Number | Online EIN Application

When you incorporate a business, you establish the business as a separate entity from yourself. That means that the business itself is liable for its debts and legal concerns, and you are not personally liable for those issues. In other words, your business structure protects your personal assets. In this vein, the main two options […]

IRS EIN Application – How to Apply for a FEIN Number Online

Wondering how to apply for an EIN number? Want more information on why you need an employer identification number (EIN) even if you are not an employer? Looking for the fastest way to get an EIN (tax ID)? To get answers to these questions and more, keep reading for tips and explanations. Apply for a […]

What is an FEIN? | Federal EIN (FEIN) Number Guide

If you’re starting a business, you probably understand your industry inside and out, but in addition to knowing your product or service, researching your target market, and focusing on closing sales, you also have to deal with a lot of accounting and tax issues. You probably have questions, including, “what is an FEIN?” To point […]

How to Apply for a Tax ID Number | Online Tax ID Application

To do business – hire employees, pay taxes, and open bank accounts – you need a Tax Identification Number. A Tax ID Number may be known as a Federal Tax ID, Employer Identification Number, or Federal Employer Identification Number. Regardless of how it is referenced, it is a unique number that represents your business. If […]

What is an LLC? | How Does an LLC Work?

When you form a new small business, you first need to decide how you want to structure it. The business structure of your new company is going to impact a few different things, such as how you pay taxes, how much legal protection you have, and how much work it takes to initially set up […]

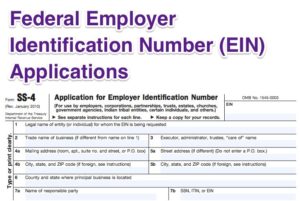

What Is an IRS Form SS-4? | Federal EIN Application

A Federal EIN Application (IRS Form SS-4) is used to request a Federal Employer Identification Number. A unique number that is used by the IRS to identify a business, an FEIN should be registered early on. Both the federal government and banking institutions often use a company’s FEIN to identify it, making an FEIN a […]

« Previous 1 2

Gov Easy LLC is an Authorized E-File Provider and helps clients obtain Federal Tax ID Numbers from the IRS. We are a business-to-business (B2B) application assistance and filing service and are not affiliated with the IRS or any other federal or state organizations. We do not provide legal, financial or other professional advice. We are not a law or an accountancy firm nor are we affiliated with either. Users are able to obtain a Tax ID number on their own by working directly with the IRS, but they will not be able to use the streamlined application process or engage with e-mail support.