Federal Tax ID State Applications

Hawaii Tax ID (EIN) Number Application

Looking to obtain your Tax ID (EIN) Number in Hawaii? This short Hawaii Tax ID Application Guide will walk you through the basic steps you need to follow to apply for your Tax ID (EIN) Number in the state of Hawaii. Whether you own a Partnership, multi-member LLC, Corporation, Non-Profit, Trust or Estate, this guide […]

Minnesota Tax ID (EIN) Number Application

You don’t need a lot of information to obtain your Tax ID (EIN) Number in Minnesota. What you do need, though, is an understanding of how to apply online. The Minnesota Tax ID Application Manual creates an informative environment, where you can easily consume the step by step process and execute on it. Whether you […]

Idaho Tax ID (EIN) Number Application

It can be expensive and time-consuming to get professional help for your organization. Things do not have to always be complicated, though, evidenced by the Idaho Tax ID Application Manual. The manual was put together to help you get a Tax ID (EIN) Number in Idaho and quickly. Acquiring an EIN number is a requirement […]

Colorado Tax ID (EIN) Number Application

The process to apply for a Tax ID (EIN) Number in Colorado is easier than ever before. You just need to know your information and the information of your partners in the organization to get the process going. Once you have the Colorado Tax ID Application Manual at your fingertips, filling out the online application […]

Obtain a Tax ID (EIN) Number and Register Your Business in Tennessee

This Tennessee Tax ID Application Manual is all you’ll need to obtain a Tax ID (EIN) Number in Tennessee. The EIN Obtainment process can all be done online now, so knowing how to apply over the Internet can allow you to get a number generated in rapid fashion. This works for all types of organizations, […]

Obtain a Tax ID (EIN) Number and Register Your Business in Indiana

For millions of Americans, entrepreneurship is a calling, and when you come up with an idea for a business that truly resonates with you, you can turn that dream into a reality. Indiana is an especially welcoming state for entrepreneurs and small business owners, but there are some important steps you’ll need to take before […]

Obtain a Tax ID (EIN) Number and Register Your Business in Washington

Every year, millions of people come up with business ideas, but only some of them ever turn that idea into something tangible. The process to become an entrepreneur is a challenging one, but it’s not as intimidating as you might think. In fact, with a handful of basic prerequisites, and a strong business plan backing […]

Obtain a Tax ID (EIN) Number and Register Your Business in Louisiana

Starting up any type of organization can be overwhelming. Whether it is an LLC, an Estate, Non-Profit, Corporation, or any other type of company, you need to know the order of getting things done. The Louisiana Tax ID Application Manual has a design base to help you better understand the EIN application process. Knowing how […]

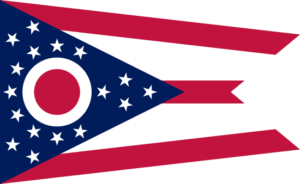

Obtain a Tax ID (EIN) Number and Register Your Business in Ohio

Starting a business requires more than just a good idea. You need to legally structure your business, and ensure it’s registered with both the federal and state-level government. Fortunately, it’s easier than ever to get the registration and tax ID you need. Apply for an Ohio Tax ID Number Apply for an Ohio Tax ID […]

Maryland Tax ID (EIN) Number Application

Applying for a Tax ID (EIN) Number in Maryland? Learn more about how to apply online using this short Maryland Tax ID Application Guide. You will need to provide some personal information about each of your partners, even if you’re a Non-Profit, Corporation, Estate of Deceased, Trust, Partnership or multi-member LLC. Get more guidance on […]

« Previous 1 2 3 4 5 6 Next »

Gov Easy LLC is an Authorized E-File Provider and helps clients obtain Federal Tax ID Numbers from the IRS. We are a business-to-business (B2B) application assistance and filing service and are not affiliated with the IRS or any other federal or state organizations. We do not provide legal, financial or other professional advice. We are not a law or an accountancy firm nor are we affiliated with either. Users are able to obtain a Tax ID number on their own by working directly with the IRS, but they will not be able to use the streamlined application process or engage with e-mail support.